When it comes to applying for a credit card, providing accurate information is crucial. However, there are instances where individuals accidentally put the wrong income on credit card application.

This mistake can have various consequences, including potential risks and complications.

In this article, we will explore the risks associated with accidentally providing incorrect income details on a credit card application and discuss potential solutions to rectify such situations.

Accidentally Put Wrong Income on Credit Card Application

If you accidentally put the wrong income on a credit card application, it is important to contact the credit card issuer as soon as possible to correct the mistake.

You can usually do this by calling the customer service number on the back of your credit card or by logging into your online account.

When you call, be prepared to provide the following information:

- Your name and account number

- The date you submitted the application

- The incorrect income information you provided

- The correct income information

The credit card issuer may ask you to provide documentation to verify your income, such as a recent pay stub or tax return.

Once you have provided the correct information, the credit card issuer will update your file and may need to re-evaluate your application.

In most cases, if you accidentally put the wrong income on a credit card application, you will not be denied a card.

However, if you have a history of making similar mistakes, the credit card issuer may be more likely to deny your application.

What are the risks of providing incorrect income information on a credit card application?

Accidentally misrepresenting your income on a credit card application can lead to several risks and issues.

It’s important to understand these risks to avoid potential complications down the line. Here are some potential risks:

- Ineligibility for the credit card: Providing incorrect income information might result in being deemed ineligible for the credit card you applied for. Credit card issuers assess your income to determine your creditworthiness and whether you can manage the card’s associated expenses.

- Reduced credit limit: Misstating your income can lead to a lower credit limit being assigned to your card. This limitation may affect your ability to make larger purchases or utilize the full benefits of the credit card.

- Credit card cancellation: If your income misrepresentation is discovered after the credit card has been issued, the credit card issuer may cancel your card. This can negatively impact your credit score and create difficulty in obtaining future credit.

- Legal consequences: Providing false income information on a credit card application can have legal implications. Misrepresenting your income may be considered fraud or deceitful behavior, potentially resulting in legal actions and penalties.

How to rectify the situation if you accidentally put the wrong income on your credit card application?

If you realize you’ve mistakenly provided incorrect income information on your credit card application, it’s essential to address the issue promptly and take appropriate steps to rectify the situation.

Here are some solutions to consider:

- Contact the credit card issuer: Reach out to the credit card issuer’s customer service department and explain the situation. Inform them about the mistake you made and provide accurate income details. They will guide you on the next steps to rectify the error.

- Submit an amendment request: Some credit card issuers allow applicants to submit an amendment request if they discover errors in their application. Check the credit card issuer’s website or contact their customer service to inquire about the process for submitting an amendment request.

- Provide supporting documentation: In some cases, credit card issuers may require supporting documentation to verify your income. This could include pay stubs, tax returns, or bank statements. Gather the necessary documents and submit them as requested to verify your correct income.

- Review credit card terms and conditions: Take the time to review the terms and conditions associated with the credit card you applied for. Understanding the card’s features, fees, and requirements will help you make informed decisions about any necessary actions.

- Consult a financial advisor: If you are unsure about how to handle the situation or require further guidance, consider consulting a financial advisor. They can provide personalized advice based on your circumstances and help you navigate the steps needed to rectify the error.

- Monitor your credit report: After rectifying the income mistake, monitor your credit report regularly. Ensure that the correct income information is reflected, and there are no inaccuracies or discrepancies. You can request a free copy of your credit report from credit reporting agencies like Equifax, Experian, or TransUnion.

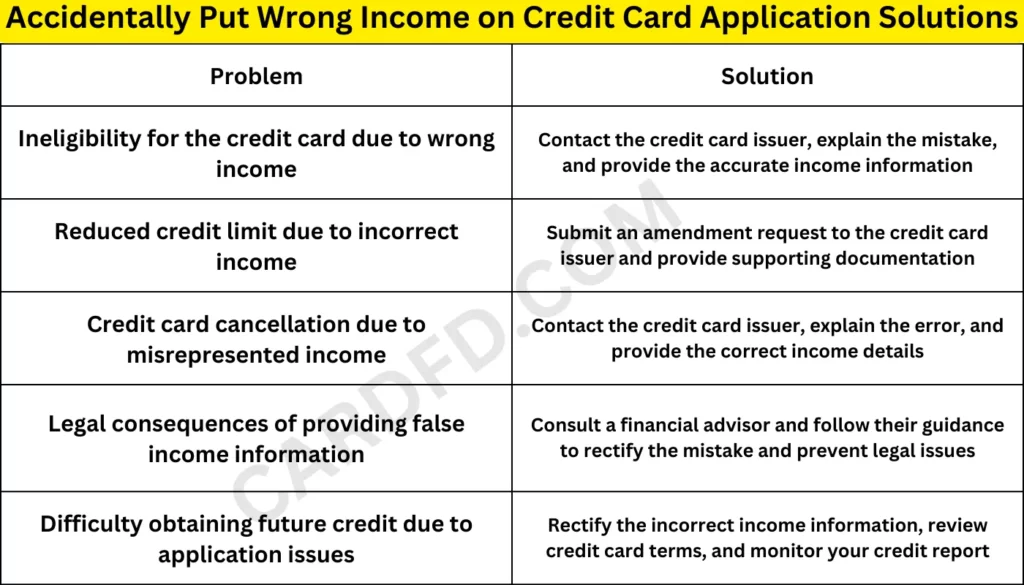

Understand These Problems and Solutions for This Situation

| Problem | Solution |

|---|---|

| Ineligibility for the credit card due to wrong income | Contact the credit card issuer, explain the mistake, and provide the accurate income information |

| Reduced credit limit due to incorrect income | Submit an amendment request to the credit card issuer and provide supporting documentation |

| Credit card cancellation due to misrepresented income | Contact the credit card issuer, explain the error, and provide the correct income details |

| Legal consequences of providing false income information | Consult a financial advisor and follow their guidance to rectify the mistake and prevent legal issues |

| Difficulty obtaining future credit due to application issues | Rectify the incorrect income information, review credit card terms, and monitor your credit report |

Important Tips

It is important to note that intentionally putting the wrong income on a credit card application is considered fraud. If you are caught doing this, you could face criminal charges and financial penalties.

Here are some tips to avoid accidentally putting the wrong income on a credit card application:

- Double-check your income information before submitting your application.

- Use the most recent pay stub or tax return available when providing your income information.

- If you are not sure how to calculate your income, ask your employer or tax preparer for help.

- Be honest with the credit card issuer if you have any changes in your income after you submit your application.

FAQs

Can providing the wrong income on a credit card application affect my credit score?

Yes, misrepresenting your income on a credit card application can have a negative impact on your credit score. It may lead to credit card cancellation, reduced credit limits, and potential legal consequences, all of which can affect your creditworthiness.

What happens if I don’t rectify the incorrect income information on my credit card application?

Failing to address the incorrect income information on your credit card application can lead to long-term consequences. It may result in credit card cancellation, difficulty obtaining future credit, and potential legal actions due to misrepresentation.

Can I get in trouble for accidentally providing incorrect income details on a credit card application?

While it is not intentional, providing incorrect income details on a credit card application can have legal implications. Misrepresentation of income is considered fraud in some cases, which can result in legal actions and penalties.

4. Will the credit card issuer contact me if they notice incorrect income information?

Credit card issuers may verify the income information provided on your application. If they notice any discrepancies, they may contact you for clarification or take appropriate action based on their policies.

How long does it take to rectify the incorrect income information on a credit card application?

The time required to rectify the incorrect income information can vary depending on the credit card issuer’s procedures and the complexity of the situation. It’s essential to address the issue promptly and follow the instructions provided by the credit card issuer.

Can I reapply for a credit card if my application gets rejected due to incorrect income information?

If your credit card application is rejected due to incorrect income information, it’s advisable to wait and rectify the situation before reapplying. Repeated rejections can negatively impact your credit score. Take the necessary steps to correct the error and provide accurate information in subsequent applications.

Conclusion

Accidentally putting the wrong income on a credit card application can lead to various risks and complications.

It is essential to provide accurate information to credit card issuers to maintain a healthy financial profile.

However, if you make a mistake, it is crucial to take immediate action to rectify the situation. Contact the credit card issuer, submit an amendment request, and provide any necessary supporting documentation.

Also, consult a financial advisor if need and monitor your credit report to ensure accuracy. By following these steps, you can address the issue effectively and minimize any potential negative consequences.