Hiding credit card debt from spouse is a delicate and challenging situation that many individuals find themselves in.

It can be an emotionally charged topic, as financial transparency and trust are crucial for a healthy relationship.

However, people may have various reasons for keeping their credit card debt hidden, such as fear, shame, or a desire to maintain control over their financial decisions.

In this comprehensive article, we will explore the intricacies of hiding credit card debt from a spouse. We will delve into the underlying reasons behind this behavior, discuss the potential consequences, and provide practical advice on how to navigate this challenging situation.

Whether you are contemplating keeping your credit card debt a secret or are on the other side of the equation, this article aims to offer guidance and shed light on this complex issue.

Hiding Credit Card Debt from Spouse: The Dilemma

The decision to hide credit card debt from a spouse is fraught with emotional and ethical considerations.

While every situation is unique, there are common themes that arise when examining why individuals choose to keep their debt concealed.

1. Fear of Judgment and Shame

Many individuals who hide their credit card debt from their spouse do so out of fear of being judged or facing feelings of shame.

They may worry about being seen as irresponsible or incompetent in managing their finances. This fear can stem from societal expectations or personal insecurities, making it difficult to openly discuss their debt.

2. Desire for Autonomy and Control

Some individuals feel a strong desire for autonomy over their finances. They may want to maintain control and make independent decisions about how to handle their credit card debt without interference or criticism from their spouse.

This desire for control, although understandable, can strain the trust and openness within a relationship.

3. Fear of Conflict

Financial matters can be a significant source of conflict in relationships. Individuals who hide their credit card debt may do so to avoid arguments or tension with their spouse.

They might believe that keeping their debt hidden is the path of least resistance, hoping to maintain harmony in their relationship.

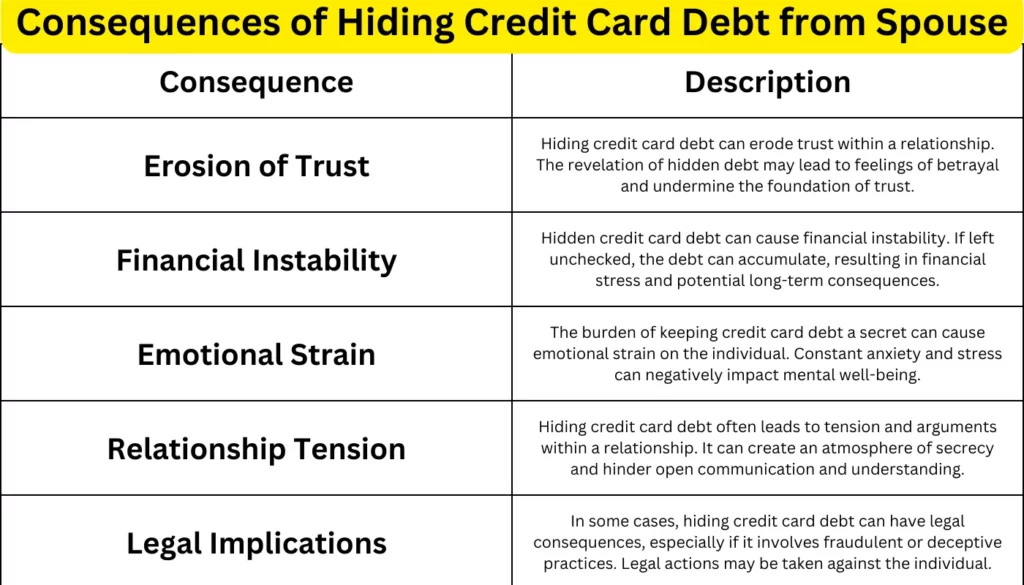

The Potential Consequences

While the reasons for hiding credit card debt may be understandable, it is crucial to recognize the potential consequences that can arise from such behavior. Here are some of the possible outcomes.

1. Erosion of Trust

Trust is the foundation of any healthy relationship. Hiding credit card debt from a spouse can severely undermine the trust between partners.

When the truth is eventually revealed, it can lead to feelings of betrayal, anger, and a breakdown in communication.

2. Financial Instability

Hidden credit card debt can create financial instability within a marriage. If the debt remains undisclosed, it may accumulate and spiral out of control, leading to a significant burden on the individual and potentially affecting the financial well-being of both partners.

3. Strained Relationship

The emotional toll of hiding credit card debt can strain a relationship to its breaking point. The constant anxiety and stress of maintaining this secret can erode the emotional connection between spouses and create an atmosphere of secrecy and distrust.

How to Approach the Situation

If you find yourself contemplating hiding credit card debt from your spouse, it is essential to consider alternative approaches that can foster openness and trust in your relationship. Here are some steps to navigate this challenging situation:

1. Self-Reflection and Awareness

Begin by reflecting on your motivations for hiding credit card debt. Consider the underlying emotions and fears that drive this behavior.

Awareness of your own feelings can help you make more informed decisions and communicate more effectively with your spouse.

2. Open and Honest Communication

Engage in open and honest communication with your spouse about your financial situation. Choose a calm and non-confrontational setting to discuss your concerns, fears, and the reasons why you initially chose to hide the debt. Transparency is vital in rebuilding trust.

3. Seek Professional Guidance

Consider seeking the guidance of a financial counselor or therapist who specializes in couples’ finance. A neutral third party can help facilitate productive conversations and provide strategies for managing debt and restoring financial stability within your relationship.

Methods for Hiding Credit Card Debt from Spouse

| Method | Description |

|---|---|

| Cash Transactions | Making purchases with cash to avoid leaving a paper trail on credit card statements. This method requires disciplined cash management and may raise suspicion if excessive. |

| Transferring Debt to Another Account | Transferring credit card debt to a different account under your name or with a lower credit limit to hide the true extent of the debt. |

| Opening Secret Credit Card Accounts | Opening credit card accounts without your spouse’s knowledge and using them to accumulate debt. This method requires careful management to prevent discovery. |

| Manipulating Billing Statements | Altering or manipulating credit card billing statements to remove or hide evidence of specific transactions or debt. |

| Using Online Payment Platforms | Utilizing online payment platforms that may not leave a paper trail, such as peer-to-peer payment apps or prepaid debit cards. |

| Colluding with Credit Card Companies | In some rare cases, individuals may collude with credit card companies to hide or manipulate credit card debt records. |

| Keeping Separate Bank Accounts | Maintaining separate bank accounts to handle credit card payments and expenses independently, effectively concealing debt from the spouse. |

| Concealing Credit Card Statements | Intercepting or hiding credit card statements before the spouse has a chance to see them, either physically or through electronic means. |

| Making Minimum Payments Only | Consistently making only minimum payments on credit cards to create the illusion of lower debt, while the balance continues to grow. |

| Borrowing Money from Family or Friends | Seeking financial assistance from family or friends to cover credit card debt instead of disclosing the debt to the spouse. |

FAQs about Hiding Credit Card Debt from Spouse

Is it ever okay to hide credit card debt from a spouse?

While honesty and transparency are crucial in a relationship, every situation is unique. If you are genuinely struggling with the decision, it is advisable to seek professional guidance to find the best path forward for your particular circumstances.

Can hiding credit card debt lead to legal consequences?

Hiding credit card debt can have legal implications, especially if it involves fraudulent or deceptive behavior. It is essential to consult with a legal professional to understand the potential legal ramifications in your specific jurisdiction.

How can I rebuild trust after hiding credit card debt?

Rebuilding trust takes time, patience, and consistent effort. Be transparent about your financial situation, adhere to any agreed-upon financial plans, and demonstrate responsible financial behavior. Couples counseling can also be beneficial in rebuilding trust.

Should I disclose previous hidden credit card debt to my spouse?

Disclosing previous hidden credit card debt is a personal decision. Consider the impact it may have on your spouse and your relationship. Seeking professional guidance can help you navigate this sensitive conversation.

Can financial infidelity be grounds for divorce?

Financial infidelity can strain a relationship and, in some cases, lead to divorce. However, every situation is unique, and the decision to end a marriage should be carefully considered based on the overall health and dynamics of the relationship.

What if my spouse hides credit card debt from me?

Discovering that your spouse has been hiding credit card debt can be challenging. Approach the situation with empathy and open communication. Seek professional guidance if needed to address the underlying issues and work towards rebuilding trust.

Conclusion

Hiding credit card debt from a spouse is a complex and emotionally charged issue that requires careful consideration and open communication.

While the decision to disclose or hide debt is ultimately a personal one, it is vital to recognize the potential consequences and seek professional guidance when needed.

Building trust, fostering open communication, and working together as a team can help couples navigate the challenges of financial transparency and maintain a strong, healthy relationship.