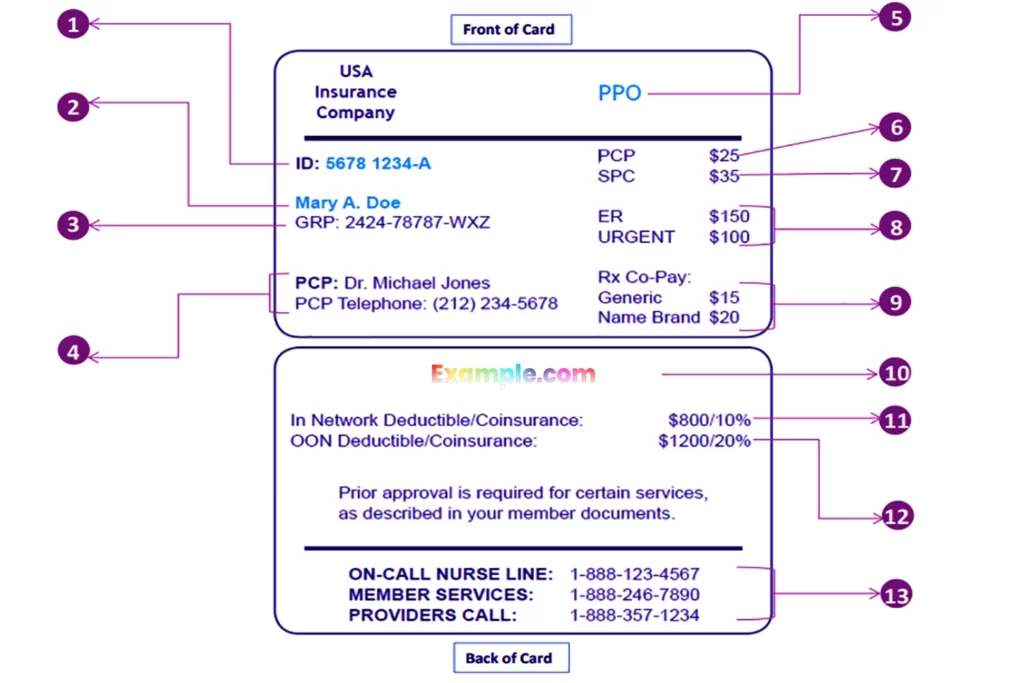

An insurance card is a small, but incredibly important, piece of documentation that contains a wealth of information about your healthcare coverage.

Whether you have private health insurance or receive coverage through your employer, your insurance card provides essential information about your plan, including your member ID number, group number, co-pays, and more.

While insurance cards may appear to be filled with jargon and confusing codes, learning how to read and interpret the numbers and information on your card can help you make more informed decisions about your healthcare and avoid unexpected costs.

In this article, we will provide a comprehensive guide to understanding all types of numbers and information on your insurance card, including member ID, group number, co-pays, plan types, and more.

All Insurance Card Numbers | How to Understand

Here are all the numbers which are mentioned on the insurance card.

1. Member ID Number

The member ID number is a unique identifier assigned to you by your insurance company. It is used to track your medical claims and ensure that you receive the benefits and coverage that you are entitled to.

The format of the member ID number may vary depending on the insurance provider. It is usually a combination of numbers and letters, and it may include dashes or other separators.

For example, a member ID number could be: ID: 5678 1234-A. In this example, the ID number is 5678 1234, and the suffix -A indicates that this is the primary member of the plan.

If there are other members on the plan, they may have different suffixes such as -B, -C, etc.

2. Member Name

The member’s name is your name, as it appears on your insurance card. It is important to ensure that your name is spelled correctly on your insurance card to avoid any issues with claims processing.

For example, a member name could be: Mary A. Doe.

3. Group Number

The group number is a unique identifier assigned to a group of people who are covered by the same insurance plan. It is used to track the benefits and coverage for the group as a whole.

The format of the group number may vary depending on the insurance provider. It is usually a combination of numbers and letters, and it may include dashes or other separators.

For example, a group number could be: GRP: 2424-78787-WXZ. In this example, the group number is 2424-78787-WXZ.

4. Primary Care Provider (PCP) Name and Phone Number

The primary care provider (PCP) is the doctor who is responsible for your general healthcare needs. The PCP name and phone number are usually listed on the card to make contacting them easy.

For example, a PCP name and phone number could be: PCP: Dr. Michael Jones, (555) 123-4567.

5. Plan Type

The plan type is the type of insurance plan that you have. There are several types of plans, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Point of Service (POS), and Exclusive Provider Organization (EPO). Each type of plan has different rules and restrictions, so it is important to understand your plan type.

For example, a plan type could be: PPO.

6. Co-Pay for Visits to Primary Care Provider

The co-pay is the fixed amount that you pay for a particular medical service. The co-pay for visits to a primary care provider (PCP) is usually lower than the co-pay for visits to a specialist. The co-pay amount may vary depending on your plan and insurance provider.

For example, a co-pay for visits to a PCP could be: PCP $25.

7. Co-Pay for Specialty Care

The co-pay for specialty care is the fixed amount that you pay for a visit to a specialist. The co-pay amount may vary depending on your plan and insurance provider.

For example, a co-pay for specialty care could be: SPC $35.

8. Co-Pays for Emergency and Urgent Care

The co-pay for emergency and urgent care is the fixed amount that you pay for a visit to the emergency room or urgent care center. The co-pay amount may vary depending on your plan and insurance provider.

For example, co-pays for emergency and urgent care could be: ER $150.

9. Prescription Drug Plan Information

The prescription drug plan information includes details about the co-payments for prescription drugs. This information may vary depending on the type of medication and whether it is a generic or brand-name drug.

For example, the prescription drug co-pay could be: Rx Co-Pay: Generic $15.

10. Health Plan Website Address

The health plan website address is the web address for the insurance provider’s website. This is where you can access information about your benefits, claims, and other important details about your plan. Also read about, getting an OTC card.

11. In-Network Deductible and Coinsurance

The in-network deductible is the amount that you must pay out of pocket before your insurance coverage begins.

The coinsurance is the percentage of the cost of the medical service that you must pay after you have met your deductible. In-network refers to healthcare providers who are part of your insurance plan’s network.

For example, an in-network deductible and coinsurance could be: In-network Deductible of $800/10%.

12. Out-of-Network (OON) Deductible and Coinsurance

The out-of-network (OON) deductible and coinsurance are similar to the in-network deductible and coinsurance, but apply to healthcare providers who are not part of your insurance plan’s network.

For example, an out-of-network deductible and coinsurance could be: an OON Deductible of $1200/20%.

13. Plan Contact Information

The plan contact information includes the phone number, email address, and website for the insurance provider’s member services department.

This is where you can get help with any questions or issues you may have with your plan.

Conclusion

Understanding the numbers and information on your insurance card can help you navigate the complex world of healthcare and make informed decisions about your coverage.

By taking the time to read and interpret your card, you can avoid unexpected costs, access the care you need, and make the most of your health insurance benefits.

Remember to keep your card safe and confidential, and contact your insurance provider with any questions or concerns about your coverage.

FAQ’s

What is the member ID number on my insurance card?

The member ID number is a unique identification number on the card that is assigned to each person covered by the insurance plan. This number is used to identify you and your coverage when you receive medical care.

Can I use my member ID number to access my insurance benefits online?

Yes, you can usually use your member ID number to access your insurance benefits online through your insurance provider’s website.

What is the group number on my insurance card?

The group number is a unique identifier for the group or employer that provides your insurance coverage. This number is used to link you to your employer’s insurance plan.

What is the purpose of the PCP name and phone number on my insurance card?

The PCP name and phone number are provided on your insurance card to help you locate and contact your primary care provider. Your PCP is usually the healthcare provider you should see for routine medical care and may need to be contacted for referrals to specialists or other medical services.

Can I share my insurance card number with someone else?

No, you should not share your insurance card number with anyone else. This number is linked to your personal information and medical history and should be kept confidential.

Can I use my insurance card number to pay for medical services?

No, your insurance card number is not a form of payment. You will still need to pay for any medical services you receive according to your insurance plan’s co-payment, coinsurance, or deductible requirements.